How I Stopped Putting All My Eggs in One Basket — And You Should Too

What if the key to growing your money isn’t about chasing high returns, but avoiding big losses? I used to think investing meant picking the next hot stock. Then reality hit — markets dip, sectors crash, and emotions run wild. That’s when I discovered asset diversification: spreading money across different types of investments. It won’t make you rich overnight, but it helps protect what you’ve worked for. Let me walk you through how this simple shift changed my wealth management game — and how it can help you stay calm, even when the market freaks out.

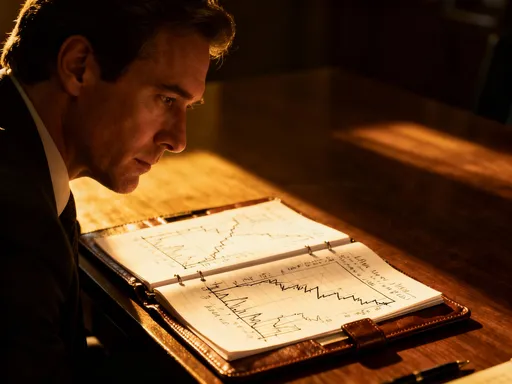

The Wake-Up Call: Why I Almost Lost Everything

For years, I believed that success in investing came from picking winners. I followed market trends closely, poured most of my savings into technology stocks during their boom, and watched my portfolio climb with excitement. At one point, over 80% of my investments were tied to a single sector. When prices soared, I felt brilliant. But that confidence didn’t last. In less than a year, a combination of rising interest rates and regulatory changes caused tech valuations to plummet. My portfolio lost nearly 40% of its value in just six months. I remember logging into my account one rainy Tuesday morning, seeing red numbers everywhere, and feeling a knot form in my stomach. It wasn’t just about the money — it was the realization that I had put everything on one bet without even realizing it.

What made the situation worse was the emotional toll. I found myself checking stock prices constantly, losing sleep over daily fluctuations, and making impulsive decisions based on fear. I sold some holdings at a loss trying to “stop the bleeding,” only to watch them recover months later. That period taught me a hard lesson: concentration may amplify gains in good times, but it magnifies losses when things go wrong. The market doesn’t care how smart you think you are — it rewards discipline, not heroics. Looking back, I wasn’t managing risk; I was ignoring it. The wake-up call came not from a financial advisor or a book, but from personal pain. And while I was fortunate enough to recover over time, the experience reshaped my entire approach to money.

The turning point came when I started asking not “How can I make more?” but “How can I lose less?” That shift in mindset opened the door to a far more sustainable strategy — one built not on luck or timing, but on structure and balance. I began researching ways to protect my savings without sacrificing growth potential. That’s how I discovered the power of diversification, a concept that sounds simple but is often misunderstood. It wasn’t about chasing more investments — it was about creating resilience through variety. And once I understood that, everything changed.

What Asset Diversification Really Means (And What It Doesn’t)

At its core, asset diversification is the practice of spreading your investments across different types of assets to reduce exposure to any single source of risk. This means holding a mix of stocks, bonds, real estate, cash equivalents, and possibly alternative investments like commodities or private equity. The goal isn’t to eliminate risk — that’s impossible in any form of investing — but to minimize the impact of poor performance in any one area. Think of it like building a house: you wouldn’t rely on just one beam to hold up the roof. Similarly, your financial future shouldn’t depend on a single stock, sector, or asset class.

One of the most common misconceptions about diversification is that owning many investments automatically means you’re diversified. But true diversification isn’t about quantity — it’s about quality and variety across categories. For example, holding ten different technology stocks doesn’t protect you if the entire tech sector declines. Those companies are likely influenced by the same economic forces, regulatory environments, and market sentiment. Real diversification comes from combining assets that behave differently under various market conditions. When stocks fall, bonds may hold steady or even rise. Real estate might appreciate during inflationary periods when other assets struggle. Cash provides stability when uncertainty peaks. By combining these, you create a portfolio that can weather different economic climates.

Another myth is that diversification guarantees profits or prevents losses entirely. That’s not the case. Even a well-diversified portfolio will experience volatility. However, research consistently shows that diversified investors tend to experience smaller drawdowns during market downturns and recover more steadily over time. According to data from Morningstar, portfolios with balanced allocations between stocks and bonds have historically delivered more consistent long-term returns than those heavily concentrated in equities alone. Diversification doesn’t promise the highest possible return — but it increases the odds of achieving your financial goals without enduring extreme swings. It’s not a magic formula, but a risk management strategy grounded in decades of financial theory and real-world results.

Why Spreading Risk Is Smarter Than Chasing Quick Wins

Many people are drawn to the idea of quick wealth — stories of overnight millionaires, viral stock surges, or crypto booms capture the imagination. But history shows that chasing high returns often leads to high regrets. Markets are unpredictable, and sectors that perform exceptionally well one year can underperform the next. Consider the dot-com bubble of the late 1990s: investors who loaded up on internet stocks saw massive gains — until the bubble burst in 2000, wiping out trillions in market value. Similarly, during the 2008 financial crisis, real estate-heavy portfolios collapsed as housing prices plummeted. Those who had diversified across asset classes, however, were better positioned to absorb the shock.

The logic behind spreading risk is rooted in the idea that no one can reliably predict the future. Even professional fund managers struggle to time the market consistently. A study by Vanguard found that over a 10-year period, more than 80% of actively managed U.S. equity funds underperformed their benchmark indexes. This doesn’t mean active investing is pointless, but it highlights the difficulty of beating the market repeatedly. Diversification sidesteps the need for perfect timing by ensuring that not all your assets move in lockstep. When one area stumbles, others may hold firm or even gain, balancing out the overall performance.

Over the long term, steady and consistent growth tends to outperform volatile spikes followed by steep drops. A portfolio that grows at 6% annually with moderate fluctuations will accumulate significantly more wealth than one that swings between +20% and -15% — even if the average return looks similar. This is due to the math of compounding: large losses require even larger gains just to break even. For instance, a 50% loss requires a 100% return to recover. By minimizing extreme losses through diversification, you preserve capital and give your investments more room to grow. This approach prioritizes sustainability over spectacle, focusing on what you can control — your risk exposure — rather than what you can’t — market movements.

Building Your Mix: How to Choose the Right Assets

Creating a diversified portfolio starts with understanding your personal financial situation. Three key factors shape your ideal mix: your investment goals, your time horizon, and your risk tolerance. Are you saving for retirement in 30 years, or building a college fund for a child entering school in five? Are you comfortable with market swings, or do sharp declines keep you up at night? Answering these questions helps determine how much risk you can afford to take — and how much you should diversify across different asset classes.

Most portfolios include three core components: equities, fixed income, and cash or cash equivalents. Equities, such as stocks or stock-based funds, offer the highest growth potential over time but come with greater volatility. They are typically best suited for long-term goals where there’s time to ride out market cycles. Fixed income, including government and corporate bonds, provides regular interest payments and tends to be less volatile. These assets help stabilize a portfolio, especially as you approach retirement or need access to funds. Cash and cash equivalents, like savings accounts or money market funds, offer safety and liquidity but minimal growth. They serve as a financial cushion during uncertain times.

Beyond these basics, some investors include alternative assets like real estate investment trusts (REITs), commodities, or private debt. These can add further diversification, especially since they often move independently of traditional stock and bond markets. For example, gold has historically acted as a hedge during periods of high inflation or geopolitical stress. However, alternatives usually require more research and may carry higher fees or lower liquidity, so they should be used thoughtfully and in moderation.

A common rule of thumb is the “100 minus your age” guideline, which suggests allocating a percentage of your portfolio to equities equal to 100 minus your age. So a 40-year-old might keep around 60% in stocks and 40% in bonds and other stable assets. While this is a helpful starting point, it’s not one-size-fits-all. Someone with a stable income and higher risk tolerance might choose a more aggressive mix, while someone nearing retirement may prefer more conservative holdings. The key is to build a mix that aligns with your life stage and financial needs — not someone else’s.

Don’t Just Diversify — Rebalance (Or Risk Drifting Off Track)

Diversification isn’t a one-time decision — it’s an ongoing process. Markets move, and over time, your original asset allocation can shift dramatically. For example, if stocks perform well for several years, they may grow from 60% of your portfolio to 80%, increasing your exposure to market risk without you realizing it. This phenomenon, known as “portfolio drift,” can leave you overconcentrated in one area, defeating the purpose of diversification. That’s why rebalancing is essential: it means periodically adjusting your holdings to bring your portfolio back to your target mix.

Rebalancing works by selling assets that have grown beyond their intended share and using the proceeds to buy more of those that have underperformed. This forces you to “sell high and buy low” — a principle that sounds simple but is emotionally difficult for many investors. Most people prefer to hold onto winners and avoid losers, but rebalancing introduces discipline into the process. It prevents complacency and keeps your risk level consistent with your long-term strategy. Studies have shown that regularly rebalanced portfolios tend to have lower volatility and more predictable returns over time.

How often should you rebalance? Most financial advisors recommend doing it once a year or every six months. Some investors set thresholds — for example, rebalancing only when an asset class deviates by more than 5% from its target. The frequency depends on your preferences and how much attention you want to give to your investments. The important thing is consistency. Even small adjustments can make a meaningful difference in maintaining balance. Rebalancing doesn’t require complex calculations or constant monitoring — just a commitment to staying on course, especially when emotions might pull you off track.

Tools and Tactics That Make Diversification Easier

For many people, the idea of building and managing a diversified portfolio feels overwhelming. But today, there are tools that make it simpler than ever — even for those with little financial experience. One of the most accessible options is the low-cost index fund, which tracks a broad market index like the S&P 500. These funds automatically hold hundreds or thousands of stocks, providing instant diversification at a fraction of the cost of actively managed funds. Because they don’t rely on stock-picking, their fees are much lower, which helps more of your returns stay in your pocket.

Another helpful tool is the robo-advisor, a digital platform that builds and manages a diversified portfolio based on your goals and risk profile. After answering a few questions, the system allocates your money across a mix of index funds and ETFs (exchange-traded funds), then handles rebalancing automatically. These services typically charge low fees — often less than 0.5% per year — and require minimal effort from the user. They’re ideal for busy parents, working professionals, or anyone who wants a hands-off approach to investing.

For those saving for retirement, target-date funds offer another streamlined solution. These funds are designed to automatically adjust their asset mix as you approach a specific year — usually retirement. For example, a “Target 2050” fund will start with a heavy allocation to stocks when you’re young and gradually shift toward bonds and cash as 2050 approaches. This built-in rebalancing removes the need for constant decision-making and helps investors stay on track without daily oversight.

These tools don’t eliminate risk, but they make smart investing more accessible. You don’t need a finance degree or hours of research to benefit from diversification. What matters most is starting early, staying consistent, and using reliable resources to support your journey. The goal isn’t perfection — it’s progress.

The Long Game: How Small Steps Create Lasting Financial Confidence

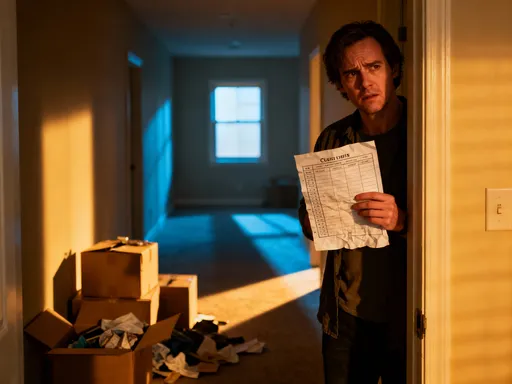

Looking back, the most valuable outcome of diversification wasn’t just financial — it was emotional. I used to feel anxious every time the market dipped. Now, I view downturns as part of the process, not a personal failure. My portfolio still fluctuates, but I sleep better knowing I’m not betting everything on one outcome. The shift from fear to confidence didn’t happen overnight, but it grew steadily as I applied simple, proven principles: spreading risk, staying balanced, and focusing on the long term.

Wealth isn’t built through sudden breakthroughs, but through consistent habits. Diversification is one of those habits — quiet, unexciting, but powerful over time. It won’t make headlines or go viral, but it builds resilience. It protects your savings from avoidable losses and gives you the peace of mind to stay invested through market cycles. And that patience compounds, not just in dollars, but in confidence.

If you’re feeling overwhelmed by investment choices or worried about losing what you’ve saved, remember this: you don’t need to be perfect. You just need to be smart, steady, and intentional. Start where you are. Assess your current holdings. Look for areas of overconcentration. Explore low-cost funds or automated tools that can help you build balance. Make a plan, and revisit it regularly. Small, thoughtful steps today can lead to significant security tomorrow.

The journey to financial resilience begins with one decision: to stop putting all your eggs in one basket. I made that choice after a painful lesson. You don’t have to wait for a crisis to begin. By embracing diversification, you’re not just protecting your money — you’re building a future where you can face uncertainty with calm, clarity, and confidence.